Mental health is about diagnosable conditions like depression and anxiety. Emotional health is about common experiences like loneliness, failure, and heartbreak, the non-diagnosable stuff.

Dear Guy

Send your requests for advice to dearguy@ted.com

Why are some people irritable all the time? And what can you do?

Maybe you have someone like this in your life … or maybe you’re the one who’s too often in a bad mood. Psychologist Guy Winch explores this common problem and shares his advice.

We all know people who just can’t apologize — well, here’s why

Non-apologizers are maddening to be around, especially when they’re clearly in the wrong. Here’s what drives their unrepentant ways and what you can do, from psychologist Guy Winch.

Dear Guy: “I’m sexually frustrated!”

This time, psychologist Guy Winch explains how to talk about an unfulfilling sex life with your partner — and get what you want.

Dear Guy: “I feel like I’m my husband’s maid!”

How do you change a very old agreement that was made in a marriage? With honesty, specificity and accountability, says psychologist Guy Winch.

Boost your emotional mastery!

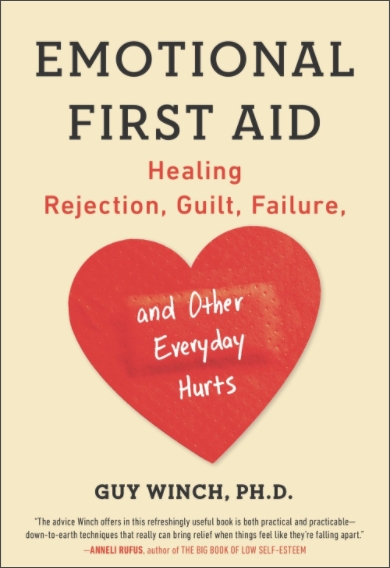

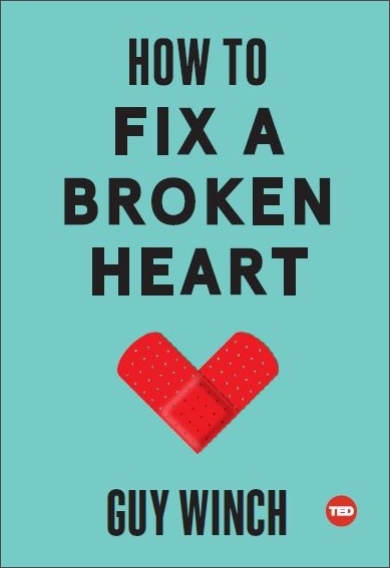

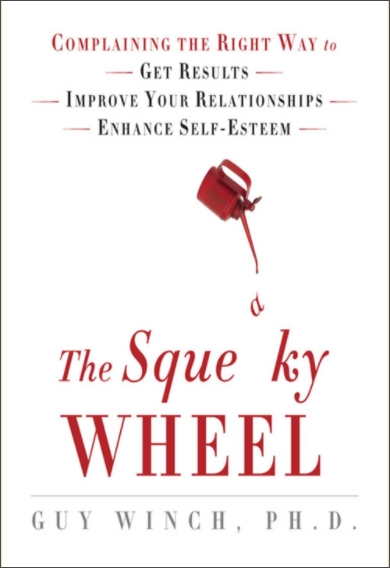

Books translated into 26 languages, and are available wherever books are sold!

Available in Book, eBook, & Audiobook formats.

Want to be on the show? Send your problem to loriandguy@iheartmedia.com

SEP 18, 2023

Encore: S02 Ep 9 - Wendy’s Ruptured Friendship

Hey, Fellow Travelers. This week we’re in session with Wendy, who wonders whether a childhood friendship is worth saving after some conflict. We help her to move out of her comfort zone and tendency toward avoidance by opening up some difficult conversations she’s never had before--not just with her friend, but also with her husband.If you have a dilemma you’d like to discuss with us—big or small—email us at LoriAndGuy@iHeartMedia.com.Follow us both online:LoriGottlieb.com and on Twitter @LoriGottlieb1 and Instagram @lorigottlieb_authorGuyWinch.com and on Twitter @GuyWinch and Instagram @Guy WinchLearn more about your ad-choices at https://www.iheartpodcastnetwork.comSee omnystudio.com/listener for privacy information.

SEP 18, 2023

Encore: S02 Ep 9 - Wendy’s Ruptured Friendship

Hey, Fellow Travelers. This week we’re in session with Wendy, who wonders whether a childhood friendship is worth saving after some conflict. We help her to move out of her comfort zone and tendency toward avoidance by opening up some difficult conversations she’s never had before--not just with her friend, but also with her husband.If you have a dilemma you’d like to discuss with us—big or small—email us at LoriAndGuy@iHeartMedia.com.Follow us both online:LoriGottlieb.com and on Twitter @LoriGottlieb1 and Instagram @lorigottlieb_authorGuyWinch.com and on Twitter @GuyWinch and Instagram @Guy WinchLearn more about your ad-choices at https://www.iheartpodcastnetwork.comSee omnystudio.com/listener for privacy information.

Select Writings

A short list of some of my most popular articles and press.

Taking Psychology to the People

APA member Guy Winch, PhD, wants to share effective strategies for managing common…

5 Things Therapists Wish You Didn’t Do During Video Sessions

Teletherapy provides a great opportunity to continue psychotherapy during a pandemic. But I've encountered a few minor challenges.

10 Ways to Make Yourself More Likable

Likability is not the most important quality but for those who strive to improve how they come across to others, here are some steps they can take to do so:

10 Signs You Have Pandemic Fatigue and How to Cope

Months of stress, anxiety and uncertainty are taking their toll on our emotional health. Here's what you can do about it.

Do Internet Based Interventions for Loneliness Work?

How close are we to providing broad based psychological interventions for loneliness to anyone with access to the internet?

Advisory Services

Corporations, Startups and Brands

Lipton

Emotional First Aid Toolkit

Alma co-practicing community: great therapists practice here

Some of the companies I've had the privilege of working with.

Read my blog! 25M+ views and counting! Most popular articles.

Read my blog! 25M+ views and counting! Most popular articles.